While the combined foreign loan of low- and middle-income countries worldwide saw a decline of 3.4% last year, Bangladesh’s loan surged by more than 6.5%. At the same time, over the course of 12 years, the loans increased by more than two-and-a-half-fold, according to a recent World Bank report.

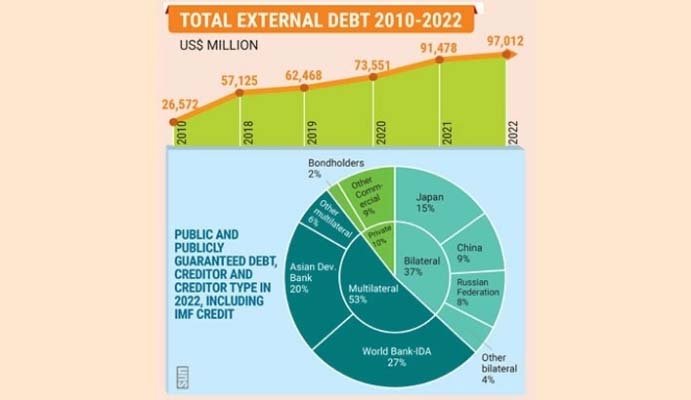

Bangladesh’s foreign loan in 2022 reached $97.01 billion, marking a notable rise from $91.47 billion in 2021, it mentioned.

The total foreign loan in 2010 stood at $26.52 billion, which escalated to over $57.12 billion in 2018, and eventually surpassed the $97 billion mark in 2022, the report added.

The World Bank has recently published the report titled “World Debt Report or Global Debt Report 2023”.

The report also highlights that the net credit flows to low- and middle-income countries declined for the first time since 2015, dropping to $185 billion in 2022 from $556 billion in 2021, a 66.72% decrease.

In a noteworthy global economic shift, the combined foreign debt of low- and middle-income countries worldwide witnessed a decline from $9.3 trillion in 2021 to approximately $9 trillion in 2022. This represents a significant 3.4% decrease in foreign debt for these countries during this period.

The dip in overall foreign debt signals a complex interplay of economic factors affecting nations across income levels. Analysts are closely monitoring these developments, considering potential implications for global financial stability and the varied economic trajectories of individual countries.

Several factors contribute to this trend, including the withdrawal of investment from government and private bonds of lower-middle-income countries, policy interest rate hikes globally to combat inflation, and increased bond interest rates in Europe and the United States.

Increasing bond interest rates in Europe and the United States have triggered a significant shift in investment patterns, with investors withdrawing a substantial $127.1 billion from lower middle-income countries. This marks a departure from the average annual investment of $202 billion in the 2019-21 period.

Amid fluctuations in global debt trends, lower-middle-income countries eligible for loans from the International Development Association (IDA) experienced a 2.7% increase in their external debt in 2022.

This expansion contributed to the total foreign debt of these countries, reaching a significant milestone at $1.1 trillion. Analysts are scrutinising the implications of this shift on the financial landscape and the development prospects of IDA-eligible nations.

The report notes concerns about Bangladesh’s debt, emphasising the need for sustainable repayment and revenue generation to mitigate risks associated with foreign loans.

The overall debt-GDP ratio is below 40%, but challenges may arise if revenue income does not increase proportionally.

The World Bank has identified the withdrawal of private investors, increased debt repayment, and the rise in US dollar value as contributing factors to the negative flow of debt in lower-middle-income countries.

While global growth has slowed, these countries face challenges in maintaining budget allocations for education and health due to significant loan repayments.

The report underscores the need for strategic measures to address the evolving debt landscape, including efforts to attract and retain private investments.

Despite the challenges, the World Bank has committed to providing support, with half of the $115 billion of new money invested in developing countries in 2022 coming from the institution.