World News: In one of the biggest anti-money laundering operations here, the Singapore Police Force (SPF) rounded up a group of foreigners who had amassed about $1 billion worth of assets here.

The assets, which included properties, luxury cars and goods, were either seized, frozen or issued with prohibition of disposal orders.

The group lived in good class bungalows (GCBs) and high-end condominiums, and owned luxury cars.

The police said it received information of possible illicit activities, including suspected forged documents used to substantiate the source of funds in Singapore bank accounts.

On Tuesday, the police conducted a massive islandwide blitz, hitting several GCBs and high-end condos across Singapore simultaneously to nab several of the suspects. The areas raided included Tanglin, Bukit Timah, Orchard Road, Sentosa and River Valley.

Ten people, including a woman, were arrested and charged on Wednesday night.

They are aged 31 to 44, and are suspected to be involved in offences of forgery, money laundering and resisting arrest.

Another 12 are assisting in investigations, while eight more people are currently on the run and have been placed on a wanted list.

In a release on Wednesday, the police said the blitz involved more than 400 officers, including those from the Criminal Investigation Department, Commercial Affairs Department (CAD), Special Operations Command or riot police, and Police Intelligence Department.

The group of foreign nationals are allegedly involved in laundering the proceeds of crime from their organised crime activities overseas, linked to scams and online gambling.

The police had identified them through extensive investigations, including the analysis of suspicious transaction reports (STRs) made by financial institutions about suspicious activity.

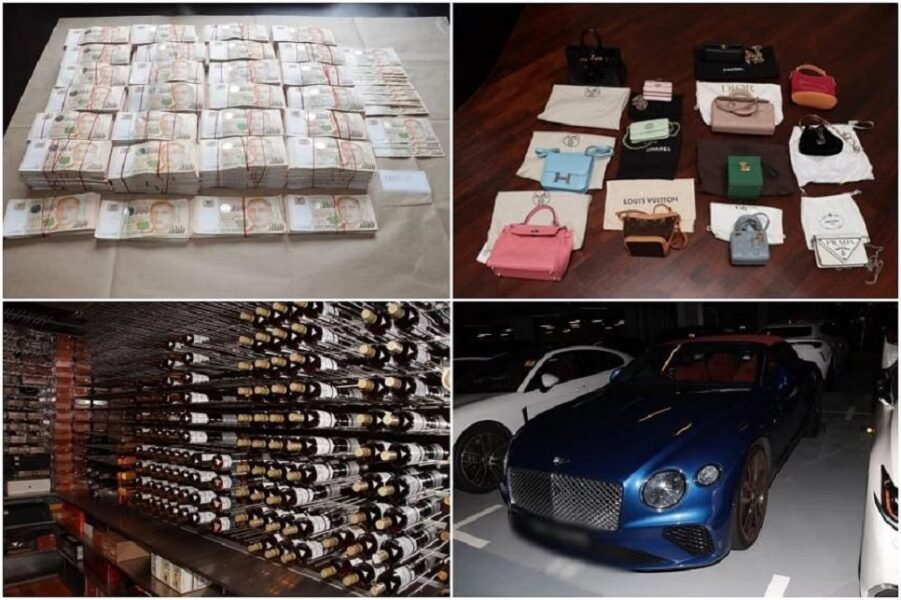

More than 250 luxury bags and watches were seized by the police during the operation. PHOTOS: SINGAPORE POLICE FORCE

On Wednesday evening, the Monetary Authority of Singapore (MAS) said it has been collaborating closely with CAD to identify potentially tainted funds and assets in the financial system and prevent their dissipation.

It added that red-flag indicators such as suspicious fund flows, dubious documentation of source of wealth or funds, and inconsistencies or evasiveness in information provided had been picked up by the financial institutions that filed the STRs.

MAS said it has ongoing supervisory engagements with the financial institutions where the potentially tainted funds have been identified, and firm action will be taken if breaches are found.

The police said prohibition of disposal orders were issued against 94 properties and 50 vehicles, with a total estimated value of more than $815 million, and multiple ornaments and bottles of liquor and wine.

The orders mean the suspects cannot sell these properties and vehicles.

The police also seized more than 35 related bank accounts with an estimated total balance of more than $110 million for investigations and to prevent transfers of the suspected criminal proceeds.

Also seized were more than $23 million in cash, more than 250 luxury bags and watches, over 120 electronic devices such as computers and mobile phones, more than 270 pieces of jewellery, two gold bars, and 11 documents with information on virtual assets.

Among those arrested was a 40-year-old Cypriot national who was arrested at the GCB he was living in at Ewart Park in Bukit Timah. The police said officers had identified themselves outside his bedroom and ordered him to open the door.

Instead, the man allegedly jumped off the second-floor balcony and was found hiding in a drain, injured. He was taken to hospital.

He allegedly had other foreign passports believed to be issued by China and Cambodia.

The police seized more than $2.1 million worth of cash from the man, and issued prohibition of disposal orders for 13 properties and five vehicles with an estimated value of more than $118 million. They also seized multiple ornaments and bottles of liquor and wine, and froze four related bank accounts with more than $6.7 million inside.

CAD director David Chew said the police will work with law enforcement agencies and financial intelligence units to detect, deter and prevent Singapore from hosting such criminal elements.

He said: “We have zero tolerance for the use of Singapore as a safe haven for criminals or their families, or for the abuse of our banking facilities.

“Our message to these criminals is simple – if we catch you, we will arrest you. If we find your ill-gotten gains, we will seize them. We will deal with you to the fullest extent of our laws.”

Ms Ho Hern Shin, MAS’ deputy managing director (financial supervision), said Singapore is vulnerable to transnational money-laundering risks as it is a global financial hub.

She said: “This case has highlighted that vigilance and prompt filing of STRs by our financial institutions have helped law enforcement authorities to identify those suspected of carrying out illicit activities.

“But it has also highlighted that as a global financial hub, Singapore remains vulnerable to transnational money-laundering/terrorism-financing risks, and that MAS and financial institutions need to continue to work together to strengthen our defences against these risks.”

Source: The Straits Times