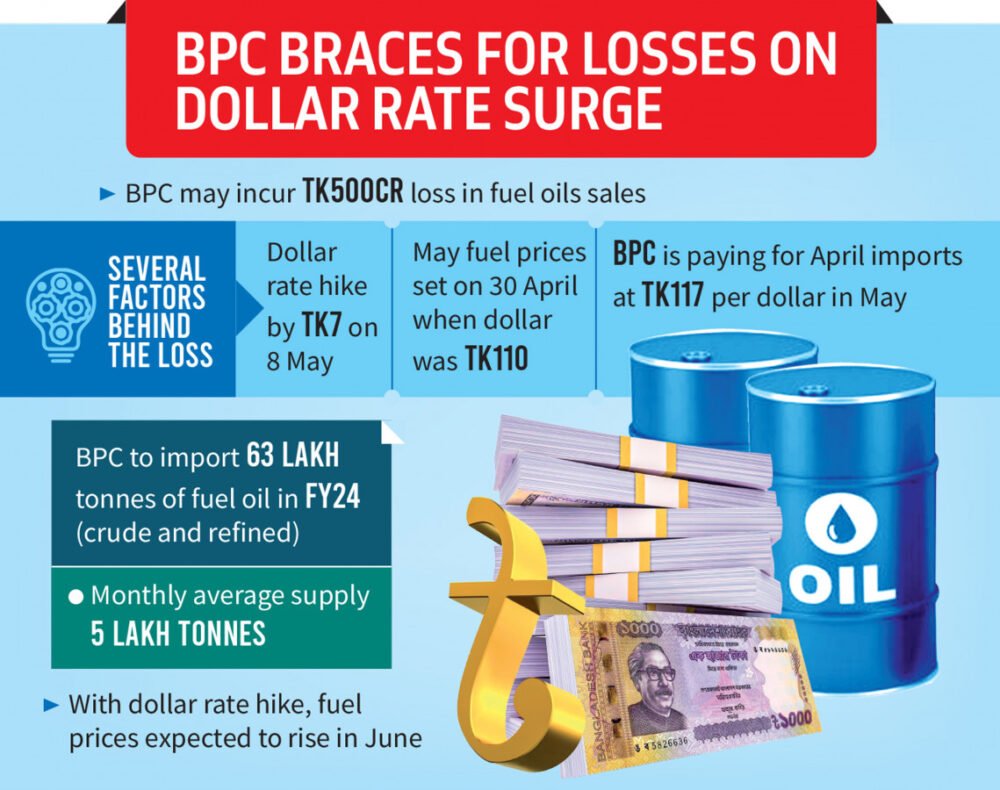

TBS/GBT: The Bangladesh Petroleum Corporation (BPC) is expecting a loss of more than Tk500 crore due to higher fuel oil import costs and lower sales prices caused by the massive increase in the dollar exchange rate, according to sources from the state-run agency.

The central bank implemented the “crawling peg” exchange rate system, raising the greenback price to Tk117 from Tk110 on 8 May, more than a week after the government set the fuel oil prices for May.

In April, fuel oil was imported at Tk110 per dollar. On 30 April, the Energy Division set the May prices at Tk107 per litre for diesel and kerosene, Tk124.50 for petrol, and Tk128.50 for octane.

However, the BPC is settling bills for most fuel oil imported in April or before the dollar rate hike in May at a rate of Tk117 per dollar but selling fuel at lower prices.

According to BPC sources, due to the dollar shortage, it will not be possible to fully pay the bills for all fuel imports even in May, leaving some payments in arrears.

The BPC imports 17-18 cargoes of fuel oil, both refined and unrefined, each month with each cargo averaging 30,000 tonnes. It is the only entity in the country that imports, distributes and markets oil and petroleum products.

BPC Chairman Amin ul Ahsan, acknowledging that the company will face some financial strain, said, ” Some losses have to be incurred as import bills are being paid at a higher dollar rate.”

However, he downplayed the impact, saying, “The BPC won’t take much of a hit as it made some profits from fuel oil sales due to a dynamic pricing approach. Combining the gains from previous months and the losses in May will not put much pressure on BPC.”

Import and demand

The BPC is projected to import around 63 lakh tonnes of fuel oil in the current fiscal year with 50 lakh tonnes of refined fuel oil and 13 lakh tonnes of crude oil.

To meet the country’s demand, the BPC is supplying an average of five lakh tonnes of fuel oil every month.

BPC officials reported lower fuel oil supplies in May due to a drop in demand for irrigation purposes following the completion of the Boro rice cultivation season. Despite this, it still managed to supply 1,83,646 tonnes of fuel oil in the first 11 days of May.

Automated fuel pricing mechanism

As part of the conditions for the International Monetary Fund (IMF) loan, the government implemented an automatic fuel price determination system in March this year.

This price is calculated by considering the international market price, the average exchange rate of the US dollar, customs duty, BPC’s margin or profit, and incidental expenses such as transportation costs, dealer and pump commissions, and system losses.

BPC currently has some outstanding debts. As of 20 May, BPC’s foreign debt amounted to around $400 million. Additionally, late payment costs will rise, as an extra 2% must be paid along with the Secured Overnight Financing Rate (SOFR) for delayed payments. As a result, BPC’s expenses will increase by around Tk200 crore.

BPC monitoring supply to prevent fuel hoarding

Traders in the fuel oil sector anticipate a price increase next month due to the rising dollar rate. BPC fears that some traders might hoard fuel oil. To address this, BPC has decided not to supply more oil in May than it did in April.

With the Boro season over, the demand for fuel oil for irrigation is currently low. Additionally, demand in the transportation sector is down due to reduced import and export activities. As a result, BPC expects slightly lower demand in May and is adjusting supply accordingly.

Despite a decrease in fuel oil prices on the international market, prices in Bangladesh will rise next month due to the increase in the dollar exchange rate. Since 8 May, opening import letters of credit (LCs) has required an additional Tk7 per dollar, raising the cost of goods and shipping.

According to BPC officials, with the dollar rate up by Tk7, the import cost of fuel oil is expected to rise accordingly. However, since international prices have slightly decreased, local prices will be adjusted accordingly.

BPC Director (Operation and Planning) Anupam Barua told TBS, “We have implemented necessary measures to prevent any potential stockpiling ahead of a price increase. BPC officials across all levels are vigilant in this matter, actively monitoring for any unusual surge in demand. Additionally, field-level officers will oversee the registry of BPC buyers, tracking their purchases and sales volumes.”