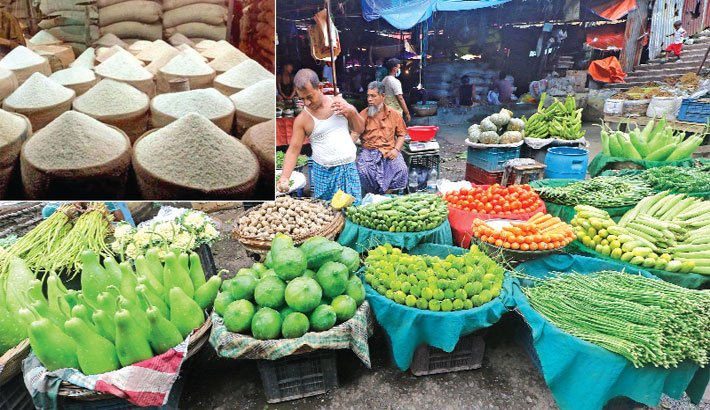

Hasibul Aman: Soaring inflationary pressure is going to be a major concern for Bangladesh’s economy as the government continues to face heightened challenges with the consumer price index (CPI) inflation, causing suffering to general consumers.

Consumer Price Index (CPI) climbed to 6.17 percent on a point-to-point basis in February, mainly fueled by soaring food prices, Bangladesh Bureau of Statistics (BBS) data show.

It was much higher than the government’s inflation target of 5.3 percent in the national budget for fiscal year 2021-22.

Official statistics show that general food inflation jumped to 6.22 percent in February from 5.60 percent one month ago, while non-food inflation eased modestly to 6.10 percent from 6.26 percent.

However, monthly inflation for these indicators were recorded at 0.43 percent and 0.32 percent respectively against 0.39 percent general monthly inflation.

Centre for Policy Dialogue (CPD) has suggested that checking the inflation must be at the centre of policy focus now as people are grappling with their limited budget to cope with skyrocketing prices of essentials.

It says the struggle of the poor and low-income group, which had begun with the Covid-19 pandemic outbreak in early 2020, further worsened amid an unabated rise in prices of commodities.

The inflationary pressure will not only hamper a sustainable and inclusive pandemic recovery but also raise inequality further, as the real purchasing power of many people will decline, it warned.

CPD and some other think tanks including SANEM criticised the government inflation data saying that it does not reflect the actual picture of the inflationary situation.

The weights used for food in the calculation of CPI are significantly higher than share of food expenditure in either income or consumption expenditure, according to CPD.

“The consumption basket used for calculating overall general inflation was created in 2005 and does not reflect the current consumption pattern of consumers or the actual prices in the market in 2022,” CPD Executive Director Dr Fahmida Khatun said.

Presenting the latest commodity price data, CPD showed that despite the Ukraine war prices of essential commodities in Bangladesh is much higher compared to that of some developed nations whose income levels are higher than Bangladesh.

The country’s economy is now feeling the pinch of huge pressure of negative current account balance due to high import bills amid the falling value of taka coupled with falling remittances.

Noted economist Prof Mustafizur Rahman thinks that keeping the taka-dollar exchange rate stable will be very critical for Bangladesh to rein in inflation.

He said Bangladesh is now paying more import bills for the same volume of imports because of the high global price of some commodities and primary energy while it is earning less from the export of the same volume.

Apart from rising global commodity prices after the start of the Ukraine war, there is also widespread allegation for artificial supply crisis of some commodities ahead of Ramadan and on the excuse of the war.

Rural inflation surged to 6.49 percent last month from January’s 6.07 percent with rural food inflation rising from 5.94 percent to 6.62 percent and non-food inflation marginally slipping from 6.32 percent to 6.25 percent, BBS data show.

Urban areas felt comparatively less inflationary pressure as its general inflation modestly rose to 5.59 percent from 5.57 percent with urban food inflation rising to 5.30 percent from 4.85 percent while non-food inflation declining from 6.17 percent to 5.91 percent.

Yearly moving average inflation during March 2021-February 2022 period, however, was recorded at 5.69 percent by the state statistics agency.