Shamim Jahangir, Dhaka: Publicly owned power plants, constituting over 40 percent of electricity generation in Bangladesh, are facing increased losses as they have become subject to double taxation, said officials.

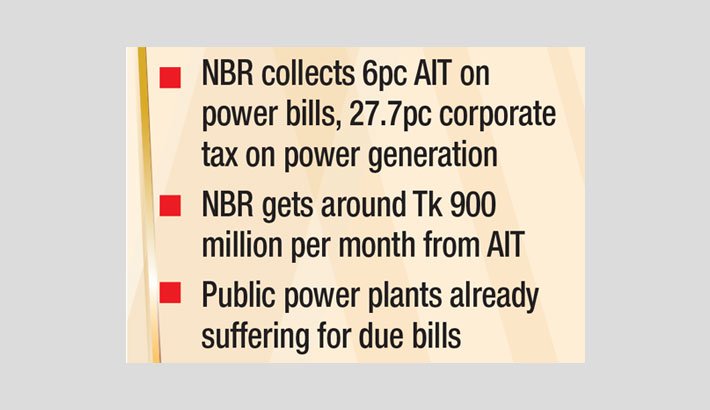

The National Board of Revenue (NBR) first collects 27.5 percent corporate import tax and then additional 6 percent of Advance Income Tax (AIT) on bulk electricity billing supplied to Bangladesh Power Development Board (BPDB).

Basically, 90 percent of the power generation cost went to fuel purchase which is a pass-through item to produce electricity. Rest of the 10 percent is accommodated as operational cost.

According to the power generation companies, the six state-owned entities incurred losses due to delay in payment of electricity bills for the past eight months due to the Russia-Ukraine war.

The amount now reached around Tk 150 billion.

Besides, the imposition of the AIT was not included in the existing power purchase agreement (PPA). So, the PPA needs to be reviewed, official sources said.

If the collection of AIT continues, then the power tariff may be upwardly adjusted, they added.

“NBR is not interested to hear anything on Advance Income Tax. It asked (the companies) to pay 6 percent AIT from June 22, 2023,” Power Division senior secretary Md Habibur Rahman told the Daily Sun.

“It pushes up the generation cost. The public power generation companies have now become some weak entities,” he added.

Md Habibur Rahman feared that the additional cost might be passed to the consumers. Power Cell director general Mohammed Hossain said six power generation companies contributed 40 percent of total power supply.

“If the NBR will continue to collect the advance tax, the public generation companies will become some losing concerns which have already suffered six months of delay in payment,” he pointed out.

The publicly owned six power plants have costs based on the use of the fuels, according to officials.

The power plants did not take any liability on fuel import or payment that is 90 percent of the total expenditure of power generation.

According to the sources concerned, the NBR has introduced the 6 percent AIT under the Income Tax Ordinance 1984 under article 52N (Income Tax Law, 2023 under section 114).

The NBR started collecting the AIT from 22 June 2023. However, the Power Division requested NBR not to collect the AIT as it was not aligned with the Power Purchase Agreement (PPA).

The NBR collected AIT at the time when public power plants were suffering huge losses and the plants became loss-making entities, they said.

But according to the NBR sources, this is not possible for the revenue authority to cancel the AIT as the tax is under section 114 of the Income Tax Law 2023. They said that the parliament is the only authority which can make a change to it.

The NBR is now mobilising around Tk 900 million per month as AIT from the public power plants.

Recently, the International Monetary Fund (IMF) advised the NBR to mobilise an additional 0.50 percent of GDP to overcome the budget deficit to some extent.

Talking over the issue, IEEFA’s Energy Finance Analyst for Bangladesh Shafiqul Alam said that the Bangladesh Power Development Board (BPDB) pays the duties for diesel and furnace oil required in the generation of electricity and the electricity it purchases from public generation companies like EGCB, NWPGCL, etc.

Now, the additional tax imposed on public generation companies for using fuel oil in power generation, which causes double taxation as the BPDB also pays the same additional tax, he said.

“This will significantly increase the cost of electricity produced by public generation companies, leading to an increase in average generation costs in the country,” Shafiqul Alam said.

Ultimately, the BPDB will have to pay higher prices to the mentioned power generation companies, he said, adding, given the annual revenue shortfall of BPDB, the government will need to pass this additional cost to the consumers.

Otherwise, the revenue shortfall of BPDB will further increase.

“However, in the prevailing situation of high commodity prices, the ordinary people will find it hard to cope with another round of electricity price hikes,” Alam said.

“While the additional tax is certainly to raise revenues, double counting should be avoided,” he suggested.

“Instead, additional tax may be imposed only on the profit of the generation companies.”