।। Waliur Rahman ।।

The people in Bangladesh have been grappling with soaring commodity prices since the very beginning of the fiscal year 2023-24, particularly with the retail price of green chillies reaching a historic high of Tk 700 per kg.

On reports of importing chillies from India, the price dropped slightly, but jumped again after sometime.

It is not just green chillies that have become a concern for the people in the new fiscal year. The prices of almost all daily necessities have witnessed a surge, putting the consumers in a tight corner.

”All the countries resorted to an increased policy interest rate to combat rising inflation. Only a few countries, including Bangladesh, did not follow the suit and kept the rate unchanged.”

The price hike did not take place all of a sudden. Rather it took a cue from the previous fiscal year when people with low and limited incomes suffered greatly due to the growing prices of almost all types of commodities.

The inflationary pressure reached a one-decade high in the previous year. Inflation had been on the rise in the preceding fiscal year of 2021-22 as well. For the following year, the authorities had initially anticipated a 5.6 per cent inflation, but it eventually stood at a staggering 9.02 per cent – the highest in more than a decade.

Inflation emerged as a blow to not only Bangladesh, but also all other countries across the globe. Soon after a relief from the pandemic restrictions, the Russian invasion on Ukraine and subsequent disruptions in the global supply chain led to a surge in commodity prices worldwide.

Almost all the countries resorted to an increased policy interest rate to combat rising inflation. Only a few countries, including Bangladesh , did not follow the suit and kept the rate unchanged. The US Federal Reserve pushed up the interest rate ten times at a stretch to a 16-year high. It made the dollars pricier and triggered a global crisis.

Here, Bangladesh adopted an apparently wrong policy to hold up the dollar price, leading to a steady decline in remittance and exports. As a result, the phrase “dollar crisis” ruled discussions in the financial and business sectors throughout the year.

The country experienced an unprecedented dollar crisis and curbed imports in the last fiscal year. Traders mostly came up with complaints of finding no dollar to import commodities. Rising global commodity prices and depreciation of local currency against the dollar contributed to the high prices in the local markets.

”The difference between the formal and informal exchange rates ranged from 12 to 18 per cent. A 1 per cent difference may result in around 3.6 per cent of remittance changing track from the official to the unofficial ones.”

Meanwhile, the depreciation of local currency against the greenback translated into a record deficit in government transactions, reduced foreign exchange reserves, and increased debt settlement costs. Also, the dollar crisis fueled a fuel crisis and hit the industrial factories hard.

However, Many countries have successfully managed to reduce inflation through aggressive policy interest rate hikes as well as benefiting from increased global supply and falling prices. It is unfortunate that Bangladesh is among the countries that could not mitigate the inflationary pressure in the meantime.

The last fiscal year also saw a crisis in remittance inflow. The central bank injected billions of dollars into the market to hold up the local currency, but it did not work out and address the underlying issues.

A significant number of expatriates started to prefer informal channels to send remittance home as the official exchange rate remained low in banks, but it skyrocketed in the kerb market.

According to the World Bank, the difference between the formal and informal exchange rates in Bangladesh during the last fiscal year ranged from 12 to 18 per cent. Even a 1 per cent difference in the exchange rates may result in around 3.6 per cent of remittance changing track from the official to the unofficial ones. It is easy to apprehend how much remittance bypassed the banking sector in the last fiscal year.

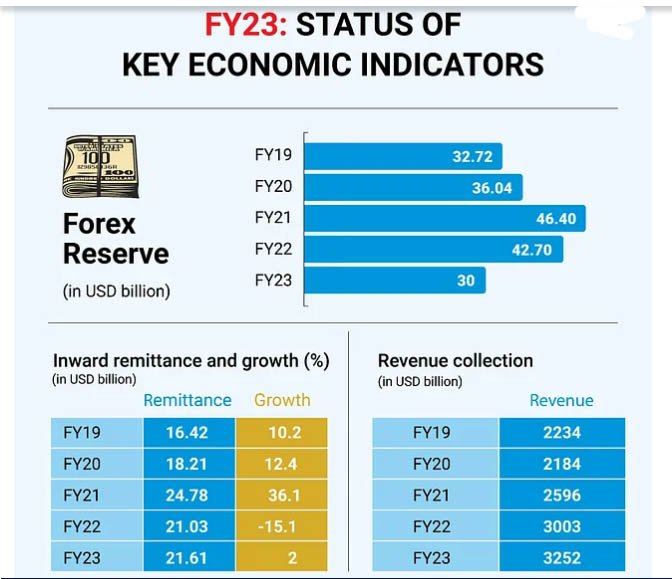

However, there was a 2 per cent increase in expatriate income at the year-end, rising from a negative growth of 15 per cent in FY22.

Export earnings also saw marginal growth and failed to meet the target. Although there was a rise in export earnings from the ready-made garments sector compared to FY22, the export performance of the other five major sectors remained a concern. They all experienced negative growth in the last fiscal year, due to falling exports to the key markets.

The decline in exports and expatriate income eventually affected foreign exchange reserves, which stood at around USD 30 billion at the year-end – the lowest in five years. Moreover, the usable reserves would amount to USD 24 billion had it calculated as per the International Monetary Fund (IMF) recommendations.

It is unlikely that the forex reserve will increase in the near future. Hence, it requires aggressive measures to boost expatriate and export earnings.

Despite dissatisfaction of traders, the government’s efforts to keep imports in check yielded positive results. The central bank restrictions on imports and surveillance on letters of credit (LCs) led to a 15 per cent reduction in imports in FY23, compared to a growth of 35.9 per cent in the previous fiscal.

The revenue collection experienced a deficit in the last fiscal year. As per provisional calculation, a total of Tk 3150 billion has been collected in the year, while the estimated deficit is around Tk 450 billion.

The private investment-to-GDP ratio declined in the year, but the authorities set a target of 28 per cent for the new fiscal year. The poor performance in the just concluded year called the ambitious target into question.

It was widely anticipated that the GDP growth would decline in the last fiscal year and the outcome aligns with the predictions.

Amid the turbulent economic conditions, the government has taken steps to introduce a floating dollar price in the new fiscal year, following the IMF recommendations. The government has shifted away from the policy of increasing interest rates to stimulate growth.

Efforts to increase reserves have been discussed, but their potential success remains uncertain. The inflation target has been set at 6 per cent, which some view as a tendency to ignore the reality.

The authorities are struggling to control the price of green chillies and other commodities. Many may consider controlling the prices of essentials as a yardstick for the government’s economic success at the end of the year.