Costlier tickets also behind decline in passengers; to offset the challenge, air carriers are exploring global horizons

Kamran Siddiqui, Dhaka: Local airlines are scrambling to tackle a dwindling revenue stream as better and faster road and rail travel is wooing away domestic travellers, reducing their passenger loads.

At the same time, the persistent inflation, exceeding 9% since March this year, costlier fuel and higher government duties have also made tickets expensive, forcing many families to reduce travel by air, industry insiders say.

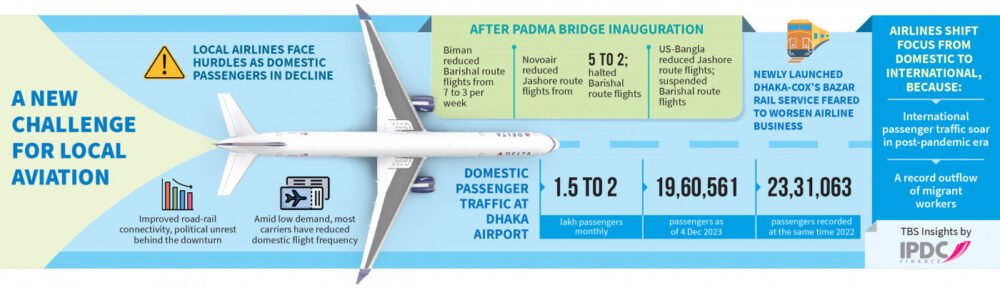

Among the airlines are the national flag carrier Biman, US-Bangla and Novoair, which are experiencing a decline in passenger numbers on major domestic routes leading to reduced flight operations, according to airline officials.

Last year, as the Padma Bridge opened for traffic, a significant decline in passenger traffic on the Jashore and Barishal air routes started to hit the airlines. This trend is likely to continue with the recent launch of a train service from Dhaka to the popular tourist destination, Cox’s Bazar, potentially diverting more passengers away from air travel.

SM Al Mahmud, CEO of a printing and publication company, printAgraphy, told TBS, “I had to go to Jessore almost every month for business and family reasons. Earlier it took three to four hours by air. A car ride took 7-8 hours to reach the destination. So I used to travel by air to save time.”

“But after the inauguration of Padma Bridge, it takes a maximum of 4 hours by private car. So I left out air travel,” he added.

“Despite the peak season, domestic routes are experiencing a passenger decline of about 20% compared to usual levels also due to the ongoing political unrest.”

This trend of choosing surface travel over air is likely to be seen in other routes as well. With the recent launch of a train service from Dhaka to the popular tourist destination, Cox’s Bazar, potentially diverting more passengers away from air travel. Others are forgoing travel altogether for the costlier air tickets.

A Dhaka-based service-holder, who used to visit Cox’s Bazar each year with his family of four for pleasure trips in December, said he was cancelling his trip this year due to the rising cost all around.

Commenting on other factors affecting their diminishing passenger loads, industry insiders said they had to adjust the minimum airfare in domestic routes in the last six months by increasing around 10% due to government-imposed travel tax and fluctuating jet fuel prices.

A Novoair official said, “We have to adjust the minimum airfare in domestic routes by Tk300-400 as the government imposed a Tk200 travel tax for the first time. Besides, jet fuel prices are rising.”

Biman sources said the carrier had reduced its Dhaka-Barishal route frequency from seven flights per week to just three following the Padma Bridge opening.

Novoair has reduced its Jashore route frequency from 5-6 weekly flights to just two after the bridge opening and stopped Barishal flights because of lack of passengers from 1 August last year.

US Bangla Airlines also reduced its Jashore route frequency, cutting six daily flights to just two. They also suspended their two daily flights on the Dhaka-Barishal route.

Mofizur Rahman, managing director of Novoair, has voiced his concern, suggesting that passenger numbers on the Cox’s Bazar route may decline by 50% following the launch of the train service.

This downturn is also an effect of the ongoing political unrest ahead of the upcoming national elections on 7 January, as reported by industry insiders.

“Despite the peak season, domestic routes are experiencing a passenger decline of about 20% compared to usual levels also due to the ongoing political unrest,” said Kamrul Islam, general manager (PR and marketing support) at US-Bangla Airlines.

Travel data shows that domestic passenger traffic at Dhaka Airport saw a decline year-on-year. Currently, an average of 1.5 to 2 lakh passengers utilise the airport for domestic travel monthly.

The industry insiders said that they have to adjust the minimum airfare in domestic routes in the last six months by increasing around 10% due to government imposed travel tax and fluctuating jet fuel prices.

A Novoair official said, “We have to adjust the minimum airfare in domestic routes by taka 300-400 as the government imposed a taka 200 travel tax for the first time. Besides, jet fuel prices are not stagnant.”

Looking outside for growth

Local airlines are now looking at international routes to make up for the lacklustre domestic revenue.

With the spread of the Covid-19 pandemic and travel restrictions, global, as well as local air travel plummeted. However, air travel demand soared internationally with easing of restrictions.

Bangladesh’s airports saw a significant rebound in international passenger traffic in 2022, surging to 90.63 lakh compared to 38.83 lakh in 2021, according to data from the Civil Aviation Authority of Bangladesh.

From January to July this year, the country’s airports handled over 72 lakh international passengers, suggesting continued growth in the following months.

The surge in international passenger traffic was further fuelled by a record outflow of migrant workers. A record 12 lakh people from Bangladesh went abroad for jobs as of November this year.

Responding to this boom, private operators are aggressively expanding their fleets on Middle East and South Asian routes to reap the bonanza.

Biman expands wings

Empty seats forced Biman to scale back its domestic operations. Mohammed Salahuddin, the director (Acting) of Marketing and Sales of Biman, told TBS, “We are facing a 10% decrease in passenger demand on domestic routes due to political reasons. However, we have decided to increase flight frequency on some Middle Eastern routes amid growing demand.”

Biman has increased flight frequencies on several international routes, including Sylhet-Jeddah-Sylhet, Sylhet-Madinah, Madinah-Chattogram, Dubai-Chattogram, Sylhet-Abu Dhabi, Chattogram-Abu Dhabi, and Chattogram-Doha. These new services are targeting Bangladeshi expatriates and hajj pilgrims returning home.

Biman has decided to operate flights to the south Indian city of Chennai starting from 16 December, specially targeting medical tourists.

Currently, US-Bangla Airlines operates flights on this route.

US-Bangla increases int’l flights

Kamrul Islam, general manager (PR and marketing support) at US-Bangla Airlines, said that passengers on the Barishal and Jashore routes started to fall since the opening of the Mawa-Bhanga Expressway and Padma Bridge.

However, he remains optimistic that air travel will not be impacted heavily by the Dhaka-Cox’s Bazar train service, as the journey takes 8-10 hours.

To offset the decline in domestic flights, US Bangla is increasing its international flights as well. It started daily flights Between Dhaka and Bangkok on 1 December, this year, which was five days a week earlier.

“We are planning to operate flights on Dhaka-Jeddah and Dhaka-Riyadh routes by next year, as we are in the process of purchasing two Airbus A330s as part of increasing flight frequency on international routes,” Kamrul said.

US-Bangla currently serves 11 international destinations with its fleet of 20 aircraft, comprising eight Boeing 737-800s, nine ATR 72-600s, and three Dash 8-Q400s.

Novoair eyes int’l expansion after election

“Despite typically experiencing 100% occupancy during this peak season on tourist-popular routes like Cox’s Bazar and Sylhet, Novoair saw a 20% decline in passenger traffic in November due to the ongoing political climate,” said Mesbah-ul Islam, head of marketing and sales at Novoair.

That is why Novoair is eyeing international expansion following the elections, with plans to operate flights on new routes depending on favourable political and economic conditions.

To support this growth, the airline is in negotiations with Airbus to acquire at least three new aircraft.

Currently, Novoair only operates internationally on the Dhaka-Kolkata route.

“We are waiting for the elections. If the situation is stable, then there is a plan to start flights to Singapore, Malaysia, Thailand, Dubai, Singapore, and Doha in a stepwise manner around April-May next year,” said an official of Novoair.

“Apart from Airbus, the existing seven ATR aircraft in our fleet will also be used on international routes as domestic passenger numbers are falling,” he said.

Air Astra also plans to go Int’l by early next year

Sakib Hasan Shovo, the deputy manager (Public Relations) of Air Astra told TBS, “Our domestic flight bookings experienced a significant decline of 30% in November. While we have observed a modest recovery this month, the numbers remain at least 15% lower than usual.”

Air Astra has three ATR aircrafts. It has a plan to add two more ATRs keeping in mind the fleet expansion in international routes as it already applied to the Civil Aviation Authority for permission.

“We hope to get permission early next year. If everything goes right, our first international flight to India might be launched by April-May next year,” Sakib Hasan added.