Ahsan Habib Tuhin, Dhaka: A majority of the publicly traded banks have achieved profit growth in the first quarter, buoyed by increased income from both lending and government securities.

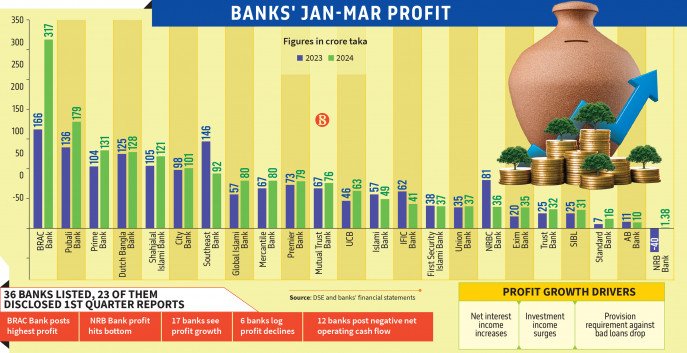

Thirty-six banks are listed on local stock exchanges, and 23 of them have disclosed their financial results for January-March this year, with 17 posting profit growth while six witnessed a decline.

Banks that maintained efficient ALM practices, prudent risk management, and implemented various cost rationalisation measures amid persistently high inflation managed to post profit growth, according to industry insiders.

Asset and liability management, known as ALM, is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting.

Syed Mahbubur Rahman, managing director at Mutual Trust Bank, told The Business Standard that banks posted higher profits amid high inflation, attributing it to increased income generated from government securities. Furthermore, the rising SMART rate also facilitated lenders ability to generate more income from disbursing loans and advances.

In July last year, the Bangladesh Bank introduced SMART (Six-month Moving Average Rate of Treasury Bills), a new lending rate formula, according to which the rate rose to as high as 13.55% in March.

Additionally, the yield on three-month Treasury bills has surged to 11.35%, marking a threefold increase over the past three years, while the yield on 10-year bonds reached a decade-high of over 12%, as per central bank data.

However, the central bank withdrew the SMART formula in May in line with the IMF prescriptions and reinstated the market-driven ratting system.

Additionally, the central bank hiked the policy rate by 50 basis points to 8.50% as part of its effort to curb inflation, making the money costlier.

Syed Mahbubur Rahman said interest rates on deposits have been on a rising trend, and the increase in policy rates has also elevated the cost of funds for banks. As a result, banks may face pressure to minimise their cost of funds.

“Now, we observe the market conditions. I believe banks’ profitability will not be hurt; rather, they will be able achieve continuous growth,” he added.

BRAC Bank secures the highest profit

In the first three months of 2024, BRAC Bank posted a Tk317 crore profit, representing 91% year-on-year growth – the highest among the listed banks.

Pubali Bank follows the list, registering a 32% growth and reaching Tk179 crore.

Meanwhile, the country’s largest private sector lender Islami Bank experienced a 14% decline in profit to Tk49 crore compared to the previous year.

NRBC Bank emerged as the worst performer, experiencing a 56% decline in profit to Tk36 crore.

Meanwhile, 12 banks posted a negative net operating cash flow per share (NOCFPS), indicating that they are in crisis due to facing liquidity shortages in the March quarter.

Among these banks, Islami Bank reported a negative NOCFPS of Tk28.17, AB Bank Tk20.7, First Security Islami Bank Tk19.46, Premier Bank Tk16.4, UCB Tk4.99, and Union Bank Tk4.39.

Default loan

At the end of December last year, the total default loan in the banking sector stood at Tk1.45 lakh crore, accounting for 9% of the total loans, which amounted to Tk16.17 lakh crore, according to Bangladesh Bank data.

The central bank recently unveiled its roadmap aimed at reducing default loans to 8% by June 2026 to comply with an IMF condition as part of a $4.7 billion loan package.

Stocks performance

Banks’ stocks accounted for 17.7% of the Dhaka Stock Exchange’s total market capitalization, amounting to Tk66,918 crore as of last week.

Investors secured 2.6% returns from bank stocks during the week. Presently, the price-earnings ratio of the banking sector stands at 7.1%, the lowest among all sectors at the bourse.

Rupali Bank emerged as the top gainer among bank stocks, recording a gain of 19.9% and closing at Tk27.7 each last week, while Uttara Bank, BRAC Bank, Prime Bank, and Shahjalal Islami Bank performed poorly.