Experts think complaints are still low compared to the reality as customers do not know how to file complaints

Mousumi Islam, Dhaka: Bangladesh Bank received 4,974 complaints against banking services in the fiscal year 2021 with a 36.91% rise from the previous year.

The complaints were related to harassment and non-availability of necessary services. However, the central bank resolved 4,950 complaints during the year.

Bangladesh Bank data showed that in FY 2019-20, the customers filed 3,633 complaints against commercial banks and the central bank resolved all of them.

Compared to the complaints received in FY 2018-19, the number, however, dropped in the following two years – by 33.93% in FY 2019-20 and 9.54% in FY 2020-21.

The data emerged in the annual report published by the Financial Integrity and Customer Service Department (FICSD) of Bangladesh Bank.

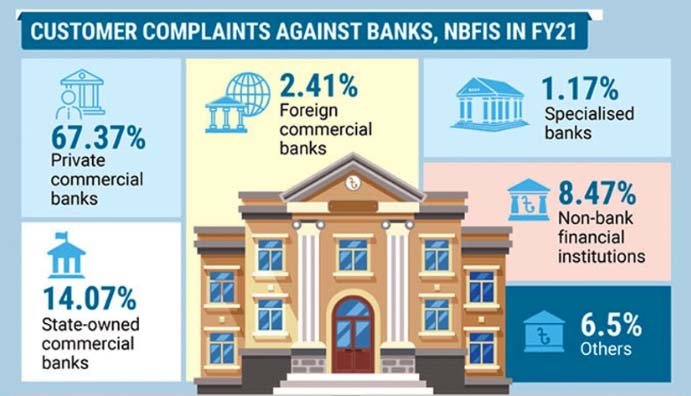

According to the Bangladesh Bank data, most of the total complaints were against private banks. The data said 87.37% of the complaints were made against the private banks, 14.07% against the state-owned banks and 2.41% against the foreign banks.

Experts think the numbers are still low compared to the size of the industry only because the people do not know that they can file complaints.

Ahsan H. Mansur, Executive Director of the Policy Research Institute (PRI), said that there is still a lack of awareness among banks’ customers that they can file complaints with the central bank when they face a service-related issue.

About the higher number of complaints in private banks, an official of a private bank said, the private banks offer more products and services than the state-owned banks.

“Private banks offer more services than the state-owned banks. For example, credit cards and digital banking systems of private banks are wider than the public banks. In this case, complaints related to services like credit cards or digital banking can come. On the other hand, these types of services in the state-owned banks are much less. So, complaints against public banks are less than private banks,” the official explained.

Any complaint related to the banking services can be filed with the FICSD of the central bank. Bangladesh Bank launched Customer Interest Protection Centre (CIPC) on April 1, 2011. Complaints can be submitted in four ways: in writing, through email, online in the prescribed form available on the Bangladesh Bank’s website, mobile phone app and telephone. Anyone can also report a problem by calling 16236 for an immediate dealing of service-related issues.

Of the complaints, 1,066 complaints were received on general banking and 634 on loans and advance, the data showed.

Besides, 415 complaints were on ATM services and credit cards, 372 on international trade bills, 351 on local trade bills, 323 on notes and coins, 285 on fees and charges, 250 on customer service dissatisfaction, 236 on remittances, 218 on bank guarantees, and 199 complaints were about mobile banking.

The report showed that local and foreign import and export bill complaints increased more in FY 2021 from FY 2020.

Bangladesh Bank has now imposed strict measures on payment of bills in import-export trade. As a result, all the complaints related to it have been resolved.

FICSD has been playing an important role in local and foreign trade by settling complaints related to import-export bills received from various exporters of the country and abroad, said the report.

According to the report, FICSD conducts special inspections along with general complaints and telephone complaints to prevent and reduce irregularities, corruption and fraud in the banking sector.

In the FY 2021, FICSD conducted 197 special inspections. Of them, 26 were conducted in the state-owned banks, 84 in the private commercial banks, 14 in the Islamic Shariah-based banks and seven in non-bank financial institutions.