The businesses of foreign tech companies are on the rise in Bangladesh as indicated by their value added tax (VAT) payments against huge earnings.

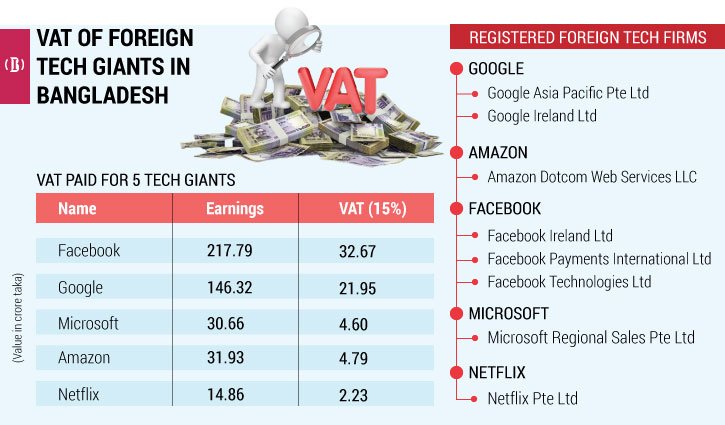

The figures show that Google, Facebook, Amazon, Microsoft, and Netflix garnered a massive Tk 442 crore earnings from Bangladeshi advertisements. They paid Tk 66 crore as 15 percent VAT against the earnings.

The five companies were registered in Bangladesh as non-resident entities at various times.

Among these non-resident companies, the popular social media platform Facebook paid the highest VAT, followed by Google, and Microsoft.

Video streaming service Netflix paid VAT for the first time in December last year after taking registration. In addition, one of the two Amazon companies has started filing returns and paying VAT from June this year. Companies are also filing regular VAT returns along with VAT.

However, it is alleged that many advertising bills of these organizations are paid outside the banking channel.

According to NBR sources, the new VAT law creates complications in getting registered as a non-resident. The National Board of Revenue (NBR) could not bring some non-resident companies operating in Bangladesh under registration.

After trying for two years, the NBR started issuing non-resident registration last year.

On May 23, 2021, two companies of Google, Google Asia Pacific Pte Limited and Google Ireland Limited, were registered.

Amazon Web Services Limited, an international service provider in cloud computing, registered on May 27 of the same year.

On January 16 this year, Facebook registered three companies- Facebook Ireland Limited, Facebook Payments International Limited and Facebook Technologies Ireland Limited.

Microsoft Regional Sales Pte Limited, a company of Microsoft Corporation, registered on July 1 this year.

Meanwhile, Netflix, a US-based video streaming platform and production company, was the latest to register.

These companies have been registered with the Dhaka South VAT Commissionerate.

Of these, Google Asia Pacific Pte Limited pays monthly filing (VAT return) and VAT in May 2021. And Facebook has been paying VAT and submitting returns since June 2021. Netflix filed vat returns in December 2021 and Amazon.com Services LLC in June this year.

According to the Dhaka South VAT Commissionerate, in the last 14 months (from June 2021 to June 2022) after taking registration, Facebook has paid the highest VAT in Bangladesh along with the highest income.

Facebook’s companies showed an income of Tk 217.79 crore in Bangladesh from advertising. On which 15 percent VAT has been paid Tk 32.67 crore.

Of these, Facebook Ireland Limited alone showed an income of Tk 217.06 crore in VAT returns against which Tk 32.56 crore VAT was paid. Facebook Payments International Limited paid Tk 6 lakh and Facebook Technologies Ireland Limited paid Tk 5 lakh as VAT showing an income of Tk 40 lakh.

Two Google companies showed income of Tk 146.32 crore in VAT returns in 14 months. Against this income, VAT has been paid Tk 21.95 crore.

Of the two companies, Google Asia Pacific Pte Limited showed an income of Tk 142.86 crore; Against which VAT was paid Tk 21.43 crore, and Google Ireland Limited paid Tk 52 lakh by showing Tk 3.46 crore.

Microsoft is the third highest grosser. The company reported an income of Tk 30.66 crore in 14 months. On the contrary, VAT was paid Tk 4.60 crore.

Amazon Web Services Limited paid Tk 4.55 crore VAT showing an income of Tk 30.33 crore.

Amazon.com Services LLC paid Tk 24 lakh in VAT in June showing an income of Tk 1.60 crore.

Netflix paid Tk 2.23 crore as VAT showing an income of Tk 14.86 crore.

According to vat Dhaka South Commissionerate, PricewaterhouseCoopers Bangladesh is working as a consulting firm for Facebook, Google, Amazon and Netflix in Bangladesh. And Poddar & Associates is working as a consultant to Microsoft.