।। Md. Zillur Rahaman ।।

Standfirst: IFFs can be generated in a variety of ways that are not revealed in national accounts or balance of payments figures, including trade mispricing, bulk cash movements, hawala transactions, and smuggling

Illicit Financial Flows (IFFs) is a growing concern not only for Bangladesh, many developing countries of the world are also suffering with this alarming issue since long and it is a very poisonous issue for any growing economy.

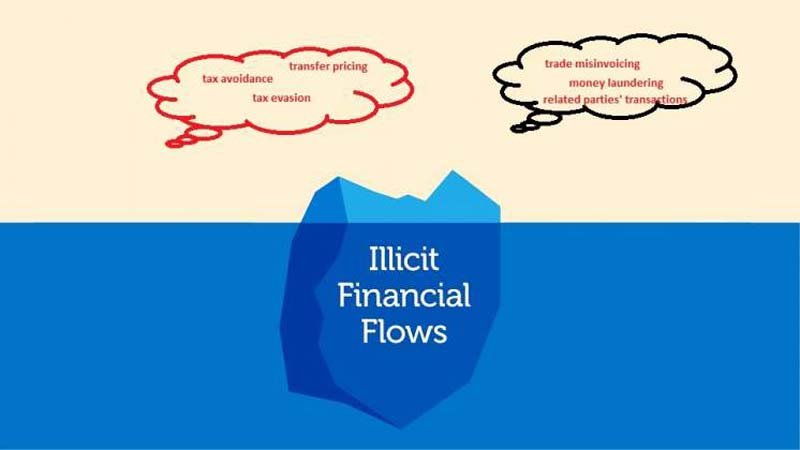

IFFs pose a huge challenge and threat to political and economic security around the world, particularly to developing countries, like Bangladesh. Corruption, organized crime, illegal exploitation of natural resources, fraud in international trade and tax evasion are as harmful as the diversion of money from public priorities. These facilitate transnational organized crime, foster corruption, undermine governance, and decrease tax revenues and hinder the economic growth and development.

IFFs, in economics, is a form of illegal movements of money or capital from one country to another and when funds are illegally earned, transferred, and/or utilized across the international border. This money is intended to disappear from any record in the country of origin, and earnings on the stock of IFFs outside a country generally do not return to the country of origin. IFFs can be generated in a variety of ways that are not revealed in national accounts or balance of payments figures, including trade mispricing, bulk cash movements, hawala transactions, and smuggling.

Recently an alarming financial report was released by Washington-based Global Financial Integrity (GFI), in its latest report on IFFs to and from the developing countries, unveiled the data of Bangladesh lost a staggering Tk 63,924 crore ($7.53 billion) a year between 2008 and 2017 to trade misinvoicing, equivalent to nearly one-fifth of the country’s tax collection target for the current fiscal year. It also said, the average value of Bangladesh’s trade misinvoicing was 17.95 percent of the country’s total trade with 135 developing countries and all of its trading partners during the same period. Bangladesh ranked 33rd globally and 3rd in South Asia in terms of IFFs of money through trade misinvoicing.

The report stated that at least US$ 5.90 billion flew out from Bangladesh illicitly in 2015 through misinvoicing in international trade with the advanced economies. The amount is closer to around two months’ merchandise export of the country. It also showed that illicit financial inflows from other countries to Bangladesh stood at $2.8 billion in 2015.

A few months ago, another alarming financial report was released by the Transparency International Bangladesh (TIB) that a sum of Tk 264 billion is being illegally remitted from Bangladesh a year while the outward legal remittances will be over $46 million. Such siphoning off of money is depriving the government exchequer of about Tk 120 billion in revenue each year.

The TIB report also stated that at least 2.50 lakh foreigners from 44 countries, most of whom are Indian nationals, are employed in more than 20 trades either regularly or irregularly in Bangladesh. But many foreign nationals show lower amount of money than they earn in wages to avoid paying taxes and the foreign workers dodge taxes in connivance with their local employers.

However, the Swiss National Bank (SNB) recently came up with the data in its annual report titled “Banks in Switzerland 2019” which also revealed that just one year after a rise, Bangladeshi nationals’ deposits in Swiss banks dropped 2.26 percent year-on-year in 2019 to 603 million Swiss francs or Tk 5,427 crore. This amount was Tk 5,553 crore in 2018 and Tk 4,329 crore in 2017, according to the report.

The GFI report explained that trade misinvoicing is a form of trade-based money laundering, made possible by the fact that trading partners write their own trade documents, or arrange to have the documents prepared in a third country (typically a tax haven), a method known as re-invoicing. Fraudulent manipulation of the price, quantity, or quality of a good or service on an invoice allows criminals, corrupt government officials, and commercial tax evaders to shift vast amounts of money across international borders quickly, easily, and almost in an undetected way.

Although IFFs are closely related to capital flight, they differ in one major respect; capital flight is an expression that places virtually the whole of the problem upon the developing countries out of which the money comes. It suggests, without quite saying so, that it is almost entirely their responsibility to address and resolve the concern. The expression IFFs does a better job of clarifying that this phenomenon is a two-way street.

IFFs can have a big impact on the economic stability of a country, like Bangladesh, and the broader global financial system. For example, they can drain foreign exchange reserves, affect asset prices, lower tax receipts and reduce government revenue. They divert resources from public spending and can cut the capital available for private investment. IFFs can also encourage criminal activity, undermining the rule of law and political stability of a country. Finally, destabilizing flows can have a negative impact on the broader economy, with potential spillovers into other economies, as they often cross borders.

It is generally presumed that IFFs are related to tax evasion and corruption. Such financial flows largely involve financial service providers, law offices and companies with transnational activities, often involving investments in real estate and other assets worth billions. Besides enabling governments and legislation, legal and accounting firms as well as shell companies have been crucial.

Businessmen, bureaucrats and politicians of Bangladesh are increasingly getting second and third homes abroad for their children. This reflects rich people have no confidence in our political and economic future.

The amount which is said to have been drained out by way of mis-invoicing — over-invoicing in import and under-invoicing in export, is a major obstacle to achieving sustainable, equitable growth. Economists warned that IFFs would not decline unless corruption were stopped. They say that the source of illegal money should be checked as no one siphon off legally earned money. They hold the central bank and customs authorities responsible for checking capital flight as they could stand guard against mis-invoicing.

In addition to such efforts on part of the central bank and customs authorities, experts have further suggested the enactment of a specific law to prevent serious financial frauds and crimes along with the institution of a competent agency as, they think, the Anti-Corruption Commission and existing regulations are not enough to check illicit capital flow.

Every dollar that leaves one country must end up in another. Very often, this means that IFFs from developing countries ultimately end up in banks in developed countries like the USA and UK, as well as in tax havens like Switzerland, the British Virgin Islands, or Singapore. GFI research suggests that about 45% of illicit flows end up in offshore financial centers, and 55% in developed countries.

Over the last several decades, Switzerland has provided wealthy families around the globe with a convenient and safe place to stash their money. The country’s political neutrality, stability and tradition of bank secrecy have kept the fortunes beyond the reach of national governments and even the most determined tax collectors.

But Swiss banks have come under global pressure in recent times, as a number of countries are stepping up crackdowns on black money. A Europe-led clampdown has also been launched on tax evasion and corruption.

GFI believes that the most effective way to limit IFFs is to increase financial transparency, i.e. 1) detect and deter cross-border tax evasion; 2) eliminate anonymous shell companies; 3) strengthen anti-money laundering laws and practices; 4) Work to curtail trade misinvoicing; and 5) Improve transparency of multinational corporations.

But black money whitening approach in the national budget is a contradictory policy to strictly curb the IFFs in the context of Bangladesh as a growing economy. Since IFFs is considered the most threat and enemy of growing economy like Bangladesh, so the government needs both institutional initiatives as well as legal reforms if they want to fight IFFs seriously. The government, under the circumstances, must put in the required institutional initiative and legal reforms to stop illicit financial flows. Every government should form a legal transparency in the way to curb the IFFs and save the economy from its ominous threat.

The writer is a banker and freelance contributor. E-mail: zrbbbp@gmail.com