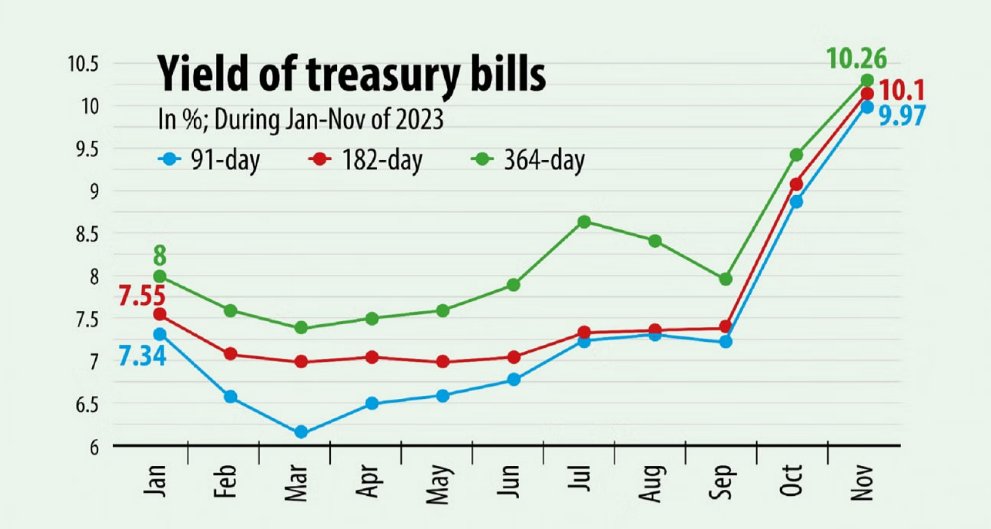

Bangladesh News Desk: The interest rate of treasury bills in Bangladesh has spiked in recent months, indicating that the lending rates will rise further in the days ahead.

The yield of treasury bills now stands at a decade high of over 11 percent whereas it was 7 percent to 8 percent a few months back, showed Bangladesh Bank data.

The government is now facing a fund shortage, which prompted the rise in the yield rates of the treasury bills, said industry insiders.

The central bank has suspended printing money for the government since this fiscal year, which was another reason for the government having to borrow money from commercial banks and individuals.

Separate auctions were held yesterday for treasury bills that mature in 91 days, 182 days and 364 days.

The government collected about Tk 6,183 crore from the treasury bills.

The yield of the 91-day bills is 11.15 percent, 182-day 11.20 percent and 364-day 11.50 percent.

Around Tk 4,300 crore was collected from the 91-day bills, Tk 600 crore from the 182-day ones and over Tk 1,200 crore from the 364-day securities.

The final auctions for the 91-day bills were held on December 28, when the interest rate was at 11.10 percent. However, in case of the 182 and 364-day securities, the yield rates were the same.

The government generally borrows from the financial sector, including the central bank, by issuing treasury bills and bonds.

The government took around Tk 98,000 crore in loans from Bangladesh Bank in fiscal year 2022-23, which was nearly 73 percent of its total borrowing from banks and non-banks at the time.

The country’s experts and economists criticised the borrowing for stoking inflationary pressure. So, the government planned to borrow from commercial banks instead.

Bankers said the higher interest of treasury bills would impact the lending rate of banks because the central bank introduced a new lending rate system linked with the debt instrument.

Bangladesh Bank withdrew the lending rate cap in June and introduced a new interest rate regime to meet conditions attached to a $4.5 billion loan of International Monetary Fund.

As per the central bank’s new formula, banks can impose a margin of 3.5 percentage points on the six-month moving average rate of treasury bills, abbreviated as SMART.

As such, the SMART continues to grow due to the rise in interest of treasury bills. The SMART was 8.14 percent in December whereas 7.72 percent in November, showed BB data.

Ahmed Shaheen, additional managing director of Eastern Bank, told The Daily Star that the individual deposits and corporate deposits were being diverted to the government securities for the high yield.

Banks have to raise the deposit rate because of the high yield of treasury bills, he added.

Echoing him, Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said it would be very difficult to mobilise deposits now because the interest rates of government’s treasury bills and bonds have continued to rise in recent times.

He said depositors were withdrawing money from banks and then investing in government treasury bills and bonds because the interest rates of the latter were over two percentage points higher than the deposit rate. Source: Daily Star